Win Stripe Chargebacks: Your Guide to Protecting Your Business in 2025

Chargebacks?

No longer your problem.

Recover 4x more chargebacks and prevent up to 90% of incoming ones, powered by AI and a global network of 15,000 merchants.

Chargebacks are no longer a sales tax because they directly affect your bottom line. With losses surging, we created this guide to help you win Stripe chargebacks, protect every transaction, and keep your business thriving.

Chargebacks can drain your revenue and threaten your Stripe account.

The losses are surging, and the patterns are similar across card networks. Yet, each card brand and payment platform, like Stripe, has specific procedures and evidence requirements that you must understand to win cases.

When a cardholder files a dispute through Stripe, the platform acts as an intermediary, helping you submit your evidence to their financial partners or the card issuer.

Stripe's role is to forward your evidence, not to determine the outcome. That decision rests with the card issuer, who evaluates whether your evidence meets their rules. If it doesn't, the issuer will reject your case and award the chargeback to the cardholder. This process typically takes 60 to 75 days, depending on the card brand involved (Visa, Mastercard, American Express, and Discover).

Read on to gain insights into the Stripe chargebacks lifecycle, learn step-by-step tips to win disputes with strong evidence, the dangers of excessive chargebacks, and how to lower your dispute rate, and proactive measures to prevent chargebacks before they happen.

Understanding Stripe Chargebacks

Stripe chargebacks occur when cardholders dispute transactions through their bank, triggering a process where you, the merchant, must prove transaction validity. Before launching a formal Stripe chargeback, some card issuers often choose to investigate a payment and request further information about the charge. This preliminary process is called an enquiry or retrieval.

To prevent an enquiry or retrieval from becoming a chargeback, submit all relevant documentation to Stripe or issue a full refund if appropriate. Refunding resolves the enquiry, and Stripe waives the counter fee.

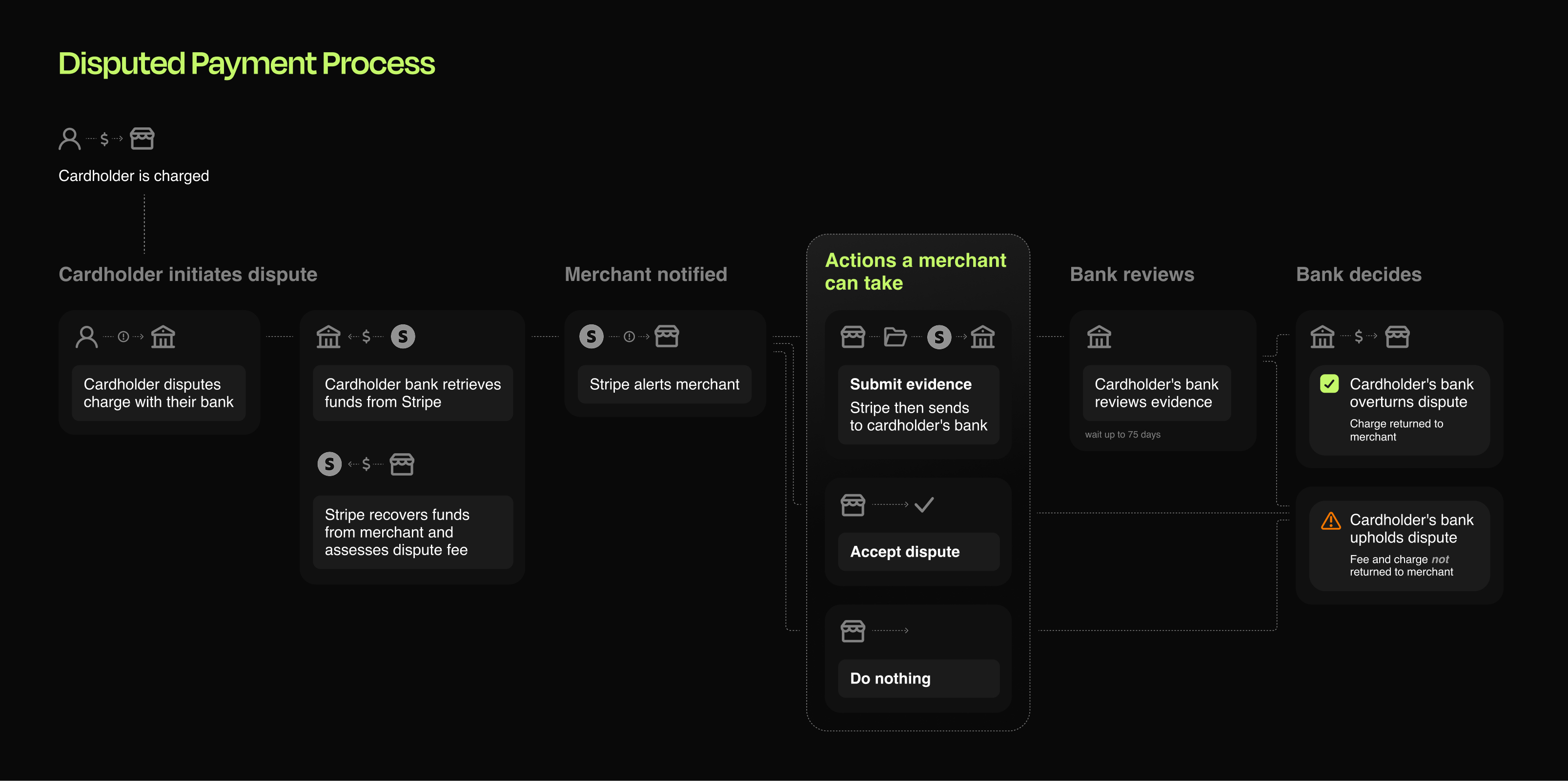

Most enquiries and retrievals arise from the cardholder claiming they do not recognize a transaction. The illustration below shows how Stripe chargebacks work:

A Typical Stripe Chargeback Lifecycle

Here’s how a Stripe chargeback works in five steps:

- Step 1: Cardholder Disputes a Transaction: The cardholder contacts their bank, citing reasons like "transaction not recognized" or "product not received." The bank deducts the disputed amount from Stripe.

- Step 2: Stripe Retrieves Funds: Stripe recovers the full amount from your merchant account and assesses a $15 dispute fee.

- Step 3: Stripe Sends Chargeback Notification: You receive a notification through the Stripe Dashboard, email, webhooks, and the API, including the reason code, dispute amount, and response time limit.

- Step 4: You Choose a Response: At this point, you can choose whether to:

- Accept the dispute (no contest).

- Challenge it by submitting evidence through Stripe's guided Stripe introduced a new $15 dispute counter fee, added on top of the existing dispute fee (totalling $30 if you lose).

- Do nothing, which defaults to accepting the dispute.

- Step 5: Cardholder’s Bank Issues Ruling: The dispute outcome can be any of the following:

- You Won: Your compelling evidence was sufficient to counter the customer’s claim, and the issuer has no choice but to return the chargeback amount to your Stripe account.

- You Lost: The bank upheld the chargeback due to insufficient or weak evidence from you. The customer will retain the chargeback amount, and you’ll incur both the dispute counter fee and chargeback fee ($30).

⚠️Key Takeaway: The entire dispute process, from dispute filing to card issuer decision, typically takes 2 to 3 months. This timeline generally can’t be shortened, unless you choose to accept the dispute directly through the Dashboard or API. Merchants have 7 to 21 days to contest a chargeback.

Now that you understand how Stripe chargebacks work, let’s explore how to win them.

How to Win Stripe Disputes

Stripe calls chargebacks “the dark side of a completed payment” – and they’re not wrong! A $1 fraudulent chargeback costs U.S. merchants $4.61 in 2025, a 37% jump from 2020 levels. That’s like paying for a customer’s purchase and extra penalties unless you fight back.

While merchants now represent a significant percentage of their chargebacks, the win rates remain minuscule (8.1%, according to Mastercard’s 2025 Chargeback Report). Why? Many lack a clear process or struggle with submitting manual evidence.

Follow these steps to improve your dispute win rate.

Step 1: Validate the Dispute

Review the reason code to determine if the claim is valid:

- Invalid Claims (e.g., friendly fraud): ALWAYS contest with strong evidence.

- Valid Claims (e.g., undelivered product or double billing): Consider refunding or resolving directly with the customer. You still need to provide Stripe with the conversation evidence if they agree to withdraw it.

Example: If the cardholder claims "transaction not recognized," gather proof, such as an AVS match, to demonstrate the billing aligns with their details and they authorized the transaction.

Step 2: Submit Timely, Precise Evidence Before Silence Becomes a Verdict

When responding to the chargeback notification, gather and submit relevant documentation that validates the original purchase. Avoid unnecessary details, such as long introductions, unnecessary product descriptions, complaints about the customer, or commentary on the perceived unfairness of the dispute.

Banks handle thousands of disputes every day. So your response must stand out. Sample evidence to submit includes the following:

- For All Disputes:

- Order confirmation with customer details.

- AVS or CVC confirmations.

- An IP address that matches the billing address.

- Prior non-disputed transactions from the same customer.

- For Physical Goods:

- Tracking details with the delivery confirmation.

- Customer signature on delivery.

- Communication logs (e.g., email confirming order).

- For Digital Goods:

- Proof of download or usage (e.g., login timestamps, account activity).

- Screenshots tying the transaction to the customer's identity.

🔔Pro Tip: Use automation tools like Chargeflow with Stripe's native features to streamline evidence collection. Automation fetches comprehensive and contextualized data, including the customer’s fraud score, increasing win rates by up to 80% for fraudulent disputes.

Step 3: Submit Within Deadlines

You only have 7-21 days to respond, depending on the card network. Missing the deadline means an automatic loss. Use Stripe's guided form to upload evidence, ensuring files are:

- Readable: Use 12-point, bold details, callouts, or an arrow to draw attention to pertinent information and avoid color highlighting.

- Focused: Crop screenshots to show only relevant information (e.g., delivery confirmation or signature) and describe their relevance.

Example: For a "product not received" dispute, submit a tracking number showing delivery to the cardholder's address, circled in the screenshot, with a note: "This confirms delivery on [date]."

Step 4: Explore Additional Options

- Resolve Directly: Contact the cardholder to offer a replacement or store credit, especially for a low-value dispute. If they agree to withdraw the dispute, submit the conversation evidence to Stripe.

- Check For CE 3.0 Eligibility: If the dispute qualifies for CE3.0, Stripe supplies most of the necessary evidence, making it easier to respond.

- Use 3D Secure: If liability shift coverage is applicable through 3D Secure, submit data evidence to shift liability to the issuer.

🔔Pro Tip: You could do all these – verify the dispute reason code, collect compelling evidence tailored to the claim, submit within 7-21 days on Stripe's form – and still lose chargebacks due to systemic issues, such as inconsistent card issuer policies, human error in evidence review, delayed chargeback notice, or evolving fraud tactics due to AI. These systemic challenges make it imperative to automate chargeback responses for consistent and comprehensive evidence submissions that adapt to fraud patterns and reduce errors.

The Dangers of Excessive Stripe Chargebacks – and What to Do If You’re Already Facing a High Chargeback Ratio

Card networks closely monitor businesses for excessive chargeback activity. While thresholds vary slightly by network, a dispute rate above 0.75% is generally considered high-risk. Exceeding the card network chargeback ratio can have serious consequences for your business, including:

- Monitoring Programs: Monthly fines up to thousands of dollars.

- Account Risks: Stripe may freeze or terminate your account, disrupting payment processing.

- Reputation Damage: Other processors may reject you as high-risk.

Stripe takes excessive chargebacks seriously. They use machine learning to monitor transaction patterns, helping merchants identify when they are approaching a dangerous threshold. These models identify behavior that correlates with chargebacks and can alert you to possible issues.

You can also do the math yourself. To figure out your chargeback rate, divide the total number of chargebacks you received in a given month by the number of transactions processed that month, multiplied by 100.

.webp)

Learn more about how the different card networks calculate chargeback ratios.

What to Do If You’re Facing an Excessive Chargeback Rate

It bears emphasizing that breaching the established chargeback-to-transaction ratio is a serious offense. You may face restrictions, fines, higher payment processing fees, burdensome reporting costs, account reserves, and the possibility of account shutdown.

If you're already experiencing that nightmare, we advise that you:

- Prevent New Cases: Use clear billing descriptors, improve customer service, and implement 3D Secure. Every new case, win or lose, will count against you.

- Use Chargeback Alerts: Tools like Chargelow Alerts notify you of impending chargebacks before they reach full term.

- Fight Fraud: Stripe Radar provides anti-fraud solutions to reduce third-party fraud, which often leads to chargebacks.

- Automate Dispute Responses: Solutions like Chargeflow are famed for providing complete chargeback coverage, from alerts to evidence collection and dispute filing, saving time and boosting win rates, all on autopilot.

As Mastercard stated: "The most effective chargeback prevention solutions are based on a robust global collaboration network. Automated tools ... help merchants and issuers significantly reduce first-party fraud by using AI-driven transaction insights and risk modeling. This approach helps to spot and prevent first-party fraud and prove genuine transactions made by the cardholder."

See how Chargeflow helped Wordtune reduce its dispute rate by 29.7%, reduce fraudulent disputes by 33.5%, and achieve a 5.4x increase in chargeback recovery rate–all while growing its revenue, as reported by Stripe.

Say Goodbye to Stripe Chargebacks

Chargeback volumes rose 8% in 2024, driven by friendly fraud and account takeover. Alarmingly, 84% of customers find filing chargebacks easier than requesting refunds (Chargeflow, 2025). So, leaving Stripe disputes to chance is like leaving your revenue unprotected.

Your chargeback ratio isn't just a number. It's a key metric for your Stripe account's health. Actively fighting and preventing false chargebacks is critical for maintaining an uninterrupted merchant account and long-term business sustainability.

Over 15,000 merchants have used automation tools like Chargeflow to simplify responses, save time, and boost win rates. You, too, can benefit from this solution.

🔔Ready to Protect Your Revenue? Contact us to learn how to stop scammers in their tracks and recover meritless disputes on autopilot. You only pay for cases won, which is a win-win!

Chargebacks?

No longer your problem.

Recover 4x more chargebacks and prevent up to 90% of incoming ones, powered by AI and a global network of 15,000 merchants.

.png)