Friendly Fraud and AI: The $132 Billion Threat to eCommerce Merchants – and How to Fight It in 2025

Chargebacks?

No longer your problem.

Recover 4x more chargebacks and prevent up to 90% of incoming ones, powered by AI and a global network of 15,000 merchants.

Friendly fraud costs eCommerce merchants billions of dollars every year. To prevent it, verify buyers, clarify charges, stay responsive, offer refunds when needed, and use dispute alerts to stop chargebacks before they are filed. Merchants are now shifting from manual representment to automated, AI powered chargeback processing, which delivers higher win rates with far less effort.

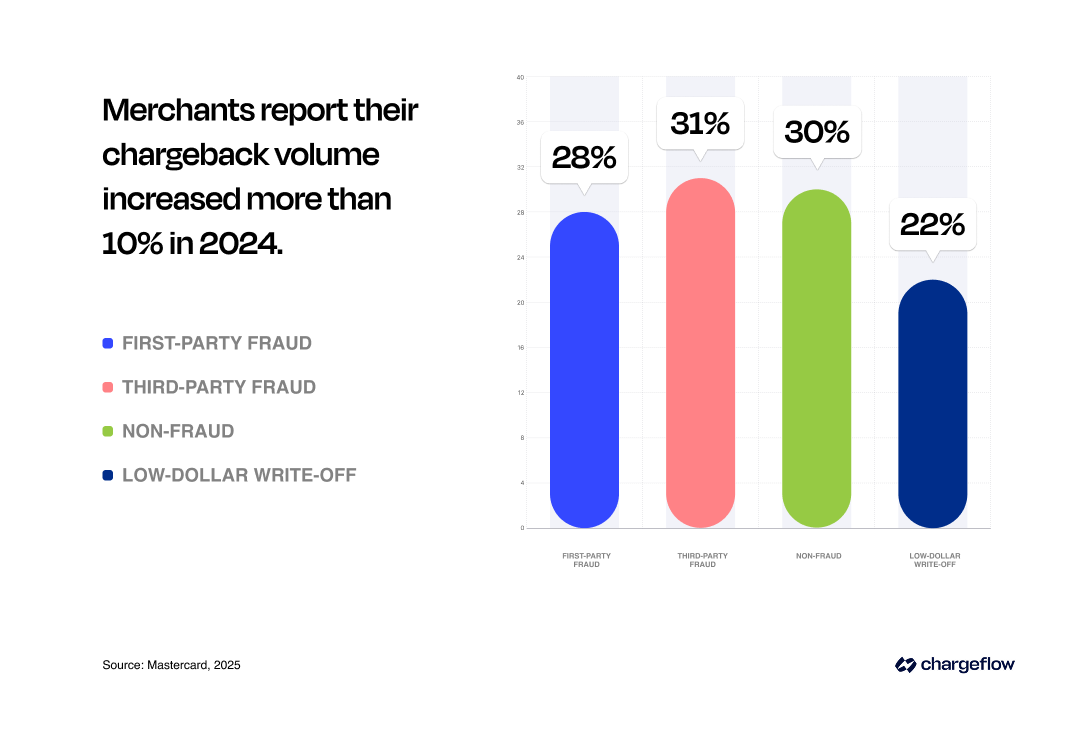

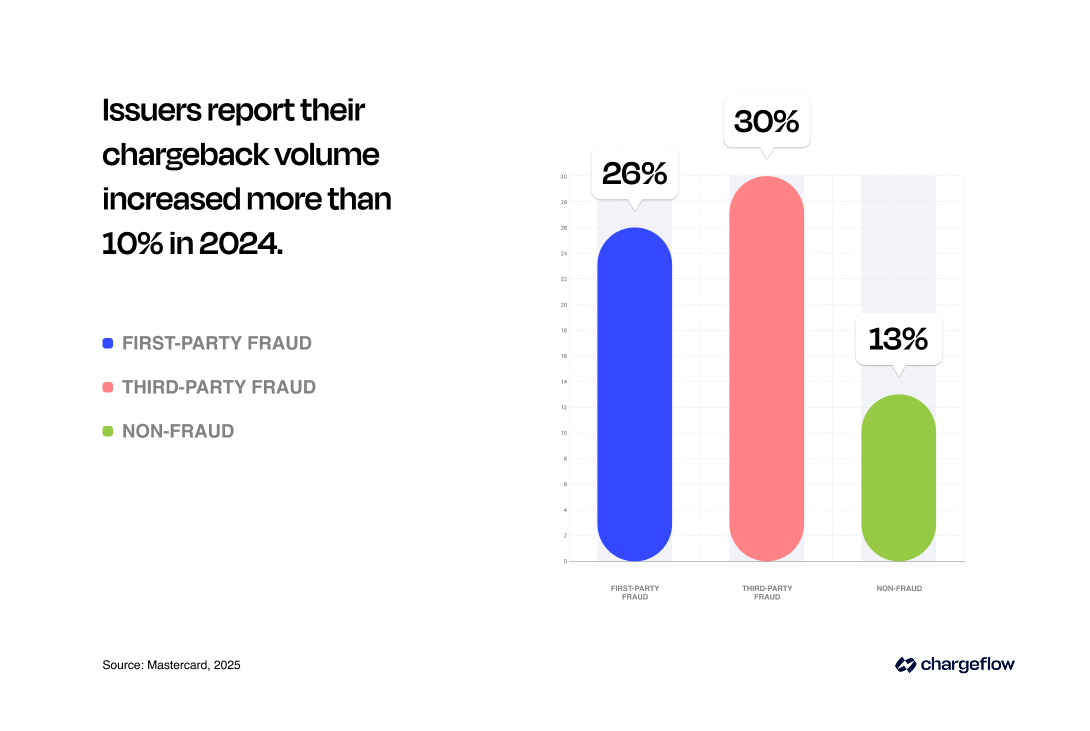

Friendly fraud is a growing threat to eCommerce, costing merchants over $132 billion annually, according to Mastercard. 25% of merchants experience more than 1 million chargeback transactions yearly, with 75% of all chargebacks attributed to friendly fraud. This isn't just a statistic. It's a crisis eroding revenue, trust, and operational efficiency. A 2024 Visa report reveals 40% of Americans know someone who has committed friendly fraud, signaling its alarming normalization.

This guide equips merchants with practical strategies, industry insights, and balanced perspectives to combat friendly fraud effectively, with an added focus on how AI and machine learning improve detection, prevention, and dispute outcomes.

What is Friendly Fraud? (And How AI Helps Identify It)

Friendly fraud, also known as chargeback abuse or first-party fraud, is when a cardholder disputes a legitimate purchase by claiming it is unauthorized or fraudulent so they can obtain a refund, while often retaining the product.

Friendly fraud differs from other chargeback cases because the instigator, the cardholder, is most likely a customer rather than a third-party fraudster. In other words, the disputed transaction warrants no chargeback claim.

While the triggers and circumstances vary from case to case, artifical intelligence (AI) now helps merchants analyze transaction behavior and detect early signs of first-party misues, but cardholders commit friendly fraud for two main reasons:

- They Forgot About the Transaction: Cardholders may not recognize a charge due to unclear merchant names on the statement or forgotten subscriptions. Cases resulting from this scenario are known as unintentional friendly fraud.

- They Want to Steal From the Business: Some cardholders exploit the chargeback system to obtain free goods or services by disputing a purchase even when there is no merchant misrepresentation. They use this strategy to get their money back if they regret or dislike a purchase. This scenario is the dictionary definition of chargeback fraud.

“First-party misuse has become more widespread and more damaging, both to merchant businesses and to the issuers, acquirers, and other payment partners that support eCommerce transactions.” – Merchant Risk Council (MRC, 2024)

The Evolution of Friendly Fraud: Why AI Matters More Than Ever

Friendly fraud was first observed in the chargeback timeline in 2010. Before then, chargebacks categorized under fraud reason codes were generally rare. They’re almost always indicative of genuine card fraud.

Today, friendly fraud is the main driver for the increase in cardholder disputes, with 79% of merchants reporting first-party fraud in 2024, up from 34% in 2023 (Visa Acceptance Solutions, 2024). The average dispute costs merchants $74 (this varies by industry, as you can see in the image below).

The spike in disputes has pushed merchants and banks to adopt AI-based fraud prevention, real-time data checks, and automated representment tools.

Why the Surge?

What’s driving this meteoric rise in fraud losses, you ask? Let's break it down:

1. Digital Commerce Explosion

More online transactions correlate to higher payment disputes, legitimate or not. eCommerce's convenience isn't without a downside. It's increasingly easier for cardholders to dispute a transaction than to contact a merchant for remediation.

2. Shifting Consumer Behavior

Cardholders expect fast, frictionless service. When disappointed, they turn to chargebacks. Behavioral AI models can now detect unusual buying or dispute patterns early, minimizing losses.

3. Flawed Chargeback System

The chargeback system was originally designed as a fair mechanism for resolving payment disputes. But it's deeply flawed. Banks and card networks prioritize the consumer. This systemic imbalance makes it much easier for cardholders to commit friendly fraud intentionally.

Many cardholders prefer to dispute a charge at the first sight of a problem rather than contact the seller. Winning those cases is no easy task for merchants. According to Mastercard, merchants win only a minuscule 8.1% of disputes they represent.

4. Social Media Influence & Emerging Trends

Platforms like TikTok popularized "chargeback hacks," where users share tips for disputing legitimate transactions (Forbes, 2024). This trend amplifies friendly fraud among younger consumers.

Over in Europe, the payments industry has recorded a new form of friendly fraud involving bank transfers rather than credit card payments. Fraudsters exploit SEPA bank transfer rules to recall payments after settlement, bypassing merchant consent. This has heightened as some banks mishandle SEPA SCT Recall requests, reversing payments without consulting the payee, thereby allowing fraudsters to reclaim funds after receiving goods or services.

5. The Tech Tug-of-War

Fraudsters use AI. Merchants must too.

The ongoing AI arms race enables fraudsters to bypass traditional security measures. Merchants often struggle to detect fraudulent disputes until it's too late. As Stripe noted, today's fraudsters operate with industrial precision, employing sophisticated teams of engineers, managers, and data analysts to execute their schemes at scale. Fraudsters are leveraging artificial intelligence at every stage of the attack, which means merchants must adopt AI as well in order to keep up, reduce false claims, and spot first-party misuse faster than manual systems ever could.

However, AI is not just a tool for fraudsters. It's also a powerful weapon for prevention. The U.S. Treasury recently announced that machine learning AI helped prevent and recover over $4 billion in fraud in FY24. We'll shed more light on AI-driven chargeback prevention in a subsequent section.

Unraveling The Detrimental Impact of Friendly Fraud

Friendly fraud affects merchants, banks, and even the perpetrators themselves. It creates a ripple effect across the eCommerce ecosystem. Here’s how friendly fraud affects these parties:

How Friendly Fraud Affects Merchants

The frequency of friendly fraud means businesses now spend more time and resources disputing meritless cases. The result?

- Revenue loss and financial difficulties.

- Sales cannibalization, since lost goods often appear in secondary markets.

- Extensive labor costs due to additional headcount to handle fraud-related issues.

- Loss of goodwill; frequent friendly fraud drives away new customers and undermines trust with existing clientele.

- Loss of sales due to strict store policies to combat rising fraud cases.

- Penalties from payment partners, including, in extreme cases, loss of payment privileges.

Despite new policies, like Visa’s Compelling Evidence 3.0, aimed at mitigating severe consequences for merchants, friendly fraud continues to be a costly problem with downstream impacts.

But it also complicates matters for banks as they become pulled into disputes between customers and merchants, which they would ordinarily not be involved in.

How Friendly Fraud Affects Banks

Card networks like Visa, Mastercard, Amex, and Discover set participation requirements for banks that issue and process their cards. These networks use chargebacks as a consumer protection mechanism to build trust in card payments and encourage card usage, while also helping them avoid regulatory backlash. However, chargebacks also expose banks to operational and financial risks.

- Dispute Costs: Banks must handle the transaction reversal process, pay additional fees, and invest in processing and investigations. These tasks are resource-intensive, and while banks may pass some costs to merchants through chargeback fees, they often still absorb significant losses, especially in high-volume or high-dispute environments.

- Trust Erosion: Card issuers are expected to protect cardholders. But routinely siding with them in weak or meritless claims, especially when merchants cannot submit compelling evidence, can damage relationships with legitimate businesses. Over time, this erodes merchants' trust in the payment ecosystem.

- Compliance Pressures: Excessive friendly fraud increases compliance burdens for financial institutions, which raises operational costs.

How Friendly Fraud Affects Cardholders

False and fraudulent chargebacks hurt merchants the most. But it also has some repercussions for perps.

While prison time is rare, cardholders who file false chargebacks still face consequences, including:

- Loss of purchasing access as merchants suspend and blacklist cardholders who perpetuate friendly fraud.

- Loss of banking rights as some banks terminate cardholder accounts of individuals known to engage in chargeback fraud.

- A poor credit score, as losing banking rights, damages the cardholder’s credit score due to a lack of credit utilization.

- Filing a frivolous chargeback means the cardholder forfeits any consideration for resolving their grievance, and if you win the case, the matter is permanently closed.

That said, the onus is still on merchants to close all loopholes that could result in friendly fraud.

How to Prevent Friendly Fraud

One of the reasons friendly fraud is incredibly challenging for merchants to deal with is that some claims are valid. Some cardholders are honest. The cardholder might have reported an actual problem.

For instance, a minor made the transaction, and the cardholder is trying to reverse it, but it's taking too long due to your store's policies.

With that in mind, below are preventive measures you can implement to stop friendly fraud from burning a hole in your balance sheet.

1. Before Transactions:

- Authenticate the buyer’s identity to stop unauthorized transactions

- Require customers to review and confirm orders before finalizing their purchase.

- Outline your return policy and ensure the customer accepts the terms.

- Consider making a phone call to confirm the purchase and address discrepancies when a high-value transaction or new customer is involved.

- Use secure payment gateways that comply with necessary security standards.

- Collect as much data as possible, including order history and contact information, to help address potential fraud, and use AI based identity and behavior checks to detect first-party misuse before a dispute occurs.

2. After Transactions:

- Send the buyer a detailed order receipt, including transaction description, order number, and details, and ensure they can access the same online. But adding AI-powered dispute alerts and behivor monitoring greatly reduces risk.

- Provide real-time tracking to limit buyer’s remorse or delivery doubts.

- Follow up with customers after delivery to confirm receipt and satisfaction; you need this tool when a chargeback arises.

- Encourage customer reviews and feedback to identify lapses or showcase your brand image to prospects.

- Follow industry best practices for posting and recording transactions.

- Use chargeback alerts to prevent friendly fraud before it happens.

🔥For Deeper Friendly Fraud Prevention Insights: Explore our guide on actionable strategies for mitigating chargebacks through consumer psychology for more insights. I also suggest you read this piece on how digital goods sellers can combat rising chargeback fraud.

How to Dispute Friendly Fraud Chargebacks Successfully

If you’re wondering whether friendly fraud claims are winnable, the answer is YES!

But success requires robust evidence and efficient processes.

Seriously, you don’t have to keep writing off those losses as the cost of sales, which is a double negative. By doing so, you’re inadvertently telling scammers to keep it coming. And, as we’ve already noted, excessive chargebacks affect your payment processing privileges. If you can't keep your chargeback rate under the card network-approved margin, you'll move into the card network monitoring program and face severe fines.

So, how do you dispute friendly fraud and win? There are two strategies you can explore:

Option A: Manual Chargeback Representment

If you choose to pursue manual representment, be prepared to gather comprehensive, compelling evidence, such as:

- Delivery proof (e.g., signed receipts, order tracking),

- Cardholder signatures or IP address match for online transactions,

- Copies of purchase receipts,

- Return policy screenshots from checkout.

- Relevant customer communication, e.t.c.

You need to submit your documentation promptly in the correct format, adhering to card network rules, and follow up if additional evidence is requested.

That said, traditional chargeback management practices are becoming increasingly ineffective, as cardholders can now file disputes with a single click. The process is time-consuming, time-consuming, and often yields poor results: only an 8.1% success rate (Mastercard, 2025).

Even major financial institutions and card networks acknowledge the complexity of the traditional chargeback process. Mastercard says, “The chargeback process is costly and time-consuming. So, it should not be surprising that Financial Institutions (FIs) are steering away from manual human review toward analysis supported by automation or AI-based models.”

Option B: Automated Chargeback Dispute

Cutting-edge systems like Chargeflow automate the entire chargeback lifecycle so you can win disputes without lifting a finger. The outcome has consistently been higher than the industry average, above 75%.

The wonderful thing about an automated chargeback management system like Chargeflow is that it:

- Uses AI to scrutinize customer footprint in real-time to pinpoint impending friendly fraud, focusing on customer intent rather than identity.

- Trains machine learning models on historical data to track inconsistencies between real transactions and fraudulent chargebacks, staying ahead of the curve in dispute prevention.

- Streamlines chargeback processing, minimizing manual tasks and empowering merchants to recover revenue with ease.

- Helps you block unwanted customers or stop chargebacks before they happen.

By the way, you only pay for successfully disputed chargebacks.

With chargeback volumes surging, 261 million this year alone, merchants are now prioritizing advanced technology and tools to streamline chargeback management.

🛑Read this case study of Chargeflow client Elementor and see how chargeback automation protects merchants from friendly fraud.

Final Thoughts on Friendly Fraud

Every research, report, or commentary on chargeback trends has one reverberating conclusion: friendly fraud is a growing challenge for eCommerce businesses. It's a $132 billion-per-year challenge with no end in sight. Artificial intelligence is becoming a critical tool in understanding transaction patterns and reducing the impact of first-party misuse.

When cardholders slap a vendor with friendly fraud, the predictable outcome is financial losses, penalties, and a damaged reputation. Without proactive measures, such as addressing fraud loopholes before processing transactions and using automated chargeback management to guard against con artists, it'll be extremely tough to survive friendly fraud. AI powered chargeback systems give merchants a faster and more accurate way to prevent disputes and strengthen evidence in real time, which is now essential for staying ahead of rising fraud trends.

Granted, you can’t possibly stop all friendly fraud cases. But you can minimize occurrences and win meritless claims that slip through the cracks. So act now! Automate your chargebacks today.

eCommerce businesses are facing myriad challenges these days. The last thing you need is to leave your chargeback management to chance.

Key Takeaways

- Scale: At least 75% of chargeback losses (or $132 billion) tie to friendly fraud.

- Prevention: Verify buyers, clarify charges, be responsive, offer refunds when necessary, and use dispute alerts to stop chargebacks in their tracks. AI can also flag high-risk behavior before a dispute occurs.

- Disputes: Merchants are shifting from manual representment to the more effective automated chargeback processing, which offers higher win rates with no stress. AI strengthens evidence, reduces manual work, and improves dispute outcomes.

By blending proactive strategies, AI driven analysis, and industry advocacy, merchants can turn the tide against friendly fraud. All the best!

Chargebacks?

No longer your problem.

Recover 4x more chargebacks and prevent up to 90% of incoming ones, powered by AI and a global network of 15,000 merchants.

.png)