Update! Chargeflow is excited to announce our new integration with Adyen! Check it out.

As an eCommerce merchant, accepting all kinds of payments seamlessly on one platform is key. Adyen, is a key competitor in the payment processing field, helping businesses make sales worldwide with cutting-edge technology that includes all the latest payment methods, smart, data-powered transactions, first-rate security features, and all-in-one commerce solutions.

As online shopping grows, that means more internet payments and more purchases. Then there’s the curve ball – the internet, the bottom line is it causes problems. More transactions translate to more fraud. It offers the opportunity for people to exploit vulnerabilities in your chargeback systems. Chargebacks serve to keep the buyers safe, but they can hit your business's bottom line, thereby putting strain on your business and your customers. Therefore, getting your chargebacks in line is more important than ever.

In this guide, we’ll walk you through the process of managing chargebacks, starting with Adyen’s robust platform. You’ll see how Adyen’s suite of payment services enables seamless transactions worldwide and equips you with the tools needed for preemptive chargeback resolution.

The Evolving Nature of Chargebacks

In recent years, the nature of chargebacks has evolved, shifting towards a more modern eCommerce landscape of online shopping, and increased volumes of transactions as well as a more diversified approach to chargebacks. This shift gained momentum during the pandemic, as a massive influx of consumers turned to online shopping, becoming increasingly aware of their rights related to chargebacks. This resulted in them being quicker to initiate disputes over issues such as quality of service, delivery problems, or even buyer’s remorse, further complicating the chargeback management process.

Entering into 2024, businesses are forced to tackle these evolving challenges. They must understand but also effectively manage chargebacks crucial to mitigate losses and maintain healthy customer relations. However, it requires not only addressing chargebacks in real-time but also implementing proactive measures to help prevent them. It requires a thorough analysis of transaction patterns that lead to chargebacks, educating customers on the repercussions of initiating such disputes, and maintaining clear and open lines of communication.

Additionally, leveraging cutting-edge technology to combat fraud and unauthorized transactions becomes the primary goal. Platforms like Adyen emerge as invaluable allies, offering a comprehensive toolkit specifically designed to help minimize chargeback risks. Including, sophisticated fraud detection systems capable of identifying suspicious activity early and dynamic 3D Secure authentication mechanisms, which help arm merchants with robust defenses against fraudulent activities.

As we mentioned before, chargeback management requires not only prevention but also prompt resolution. Adyen’s platform ensures quick dispute resolution, helping merchants address and potentially reverse unjustified chargebacks, and maintaining customer trust. To effectively manage eCommerce chargeback challenges, businesses need a clear strategy. Platforms like Chargeflow, specialize in chargeback automation, improving efficiency and easing the merchant’s workload. It is important to note here that Chargeflow is in the process of rolling out our integration with Adyen. This collaboration between payment solutions and chargeback management is essential for navigating modern eCommerce complexities.

Preventative Measures with Adyen

Preventing chargebacks should be top of mind if you want to maintain a healthy eCommerce relationship! They offer several different tools and features to help businesses prevent and mitigate chargebacks as much as possible. Let’s outline some of these tools and strategies available to you:

- Set up Risk Management Tools: By setting up Adyen’s risk management tools, you can prevent chargebacks and fraudulent transactions from ever happening. Set up your risk rules so that they are tailored to your exact business and they can block high-risk transactions or flag them for review. If you need help setting up and configuring your risk management features, click here.

- Implement Authentication Methods: Adyen’s support for strong customer authentication methods like 3D Secure 2 means you can make your website and your mobile app compliant with these authentication standards and force customers to provide additional verification before any transaction is approved, ultimately reducing fraudulent chargebacks and shifting liability away from merchants.

- Optimize Transaction Security with Dynamic 3D Secure: Apply 3D Secure based on the specific risk of each transaction. This means you can apply 3D Secure to only high-risk transactions, and allow low-risk transactions to continue without additional authentication, optimizing the checkout experience for customers, especially shoppers in geographical areas where fraud levels are much lower. To configure these rules, you’ll want to watch the video below. To learn more about Adyen's 3D Secure, click here.

- Apply Adyen’s RevenueProtect: Easily identify and block fraudulent activities with Adyen’s risk management system, RevenueProtect. This system combines machine learning with static rules to analyze huge amounts of payment data to protect against fraudulent payment activities.

- Optimize Payment Descriptions: Prevent customer disputes from unrecognized transactions by making clear payment descriptions, which are the texts your customer sees on their bank statement. Adyen allows you the ability to personalize each of these descriptions to reduce the chance of customer disputes.

- Provide Stellar Customer Service: Customer service plays a large and vital role in chargeback prevention by reducing service disputes. Quick and responsive customer service is a customer expectation and with the use of Adyen’s communication tools, you can streamline customer service notifications and updates on transactions, disputes, and refunds.

Understanding Adyen’s Chargeback Process

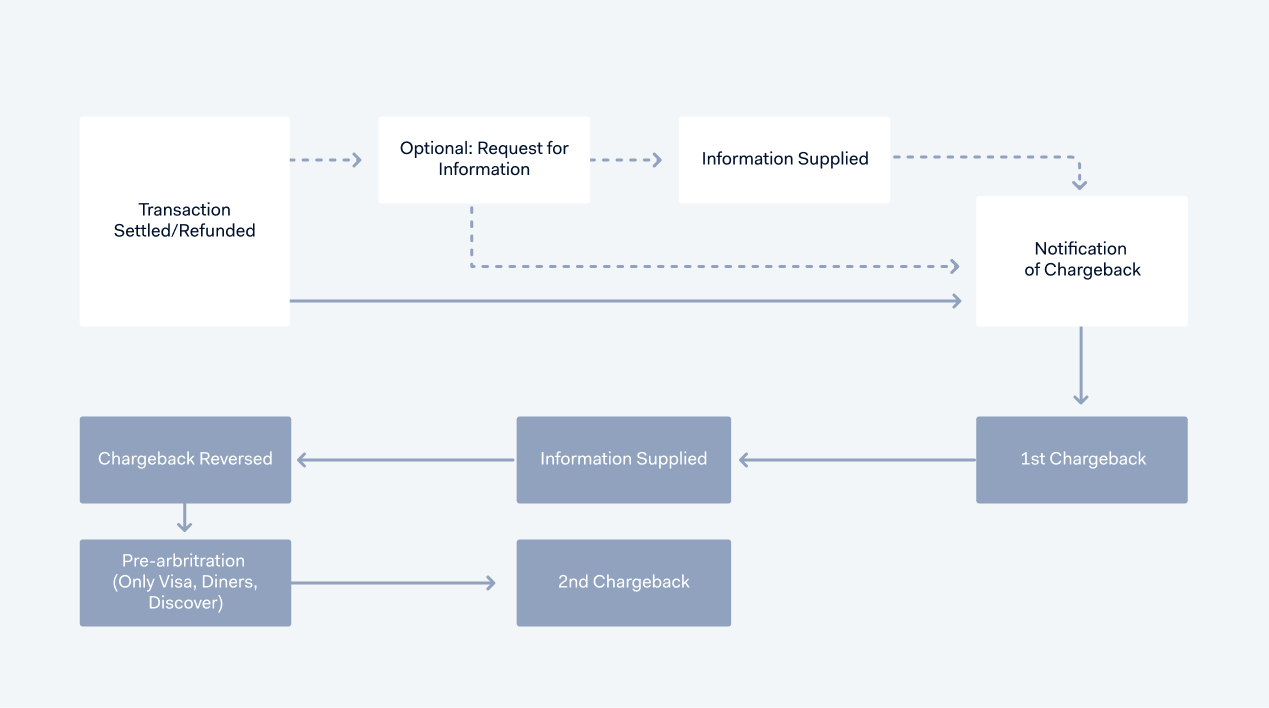

Adyen's chargeback process typically involves several stages beginning when a shopper disputes a transaction. Adyen may start with a Notification of Fraud (NOF) or a Request for Information (RFI) stage to alert you about potential fraud or to gather more details about the transaction. If these stages do not resolve the issue, they may issue a Notification of Chargeback (NoC) stage when a chargeback is initiated that can be defended.

The flow of a dispute:

With a clear grasp of the initial stages of Adyen's chargeback process, it becomes imperative to delve deeper into the specific reasons and codes that Adyen assigns to chargebacks, as this knowledge is crucial for effective dispute management and resolution.

Merchants can boost their ability to manage disputes by mastering the chargeback reasons and codes that Adyen uses to classify disputes. Adyen's chargeback reasons and codes will help merchants respond to disputes. When disputes occur, Adyen will assign a chargeback reason and associated code to the dispute. Chargeback reasons serve as a reference, or additional context, for the chargeback code. Adyen’s chargeback reasons and codes for each chargeback fall into one of four groups outlined in the Mastercard Reason Codes.

- Fraudulent Transactions: Codes in this category communicate unauthorized use or identity theft claims.

- Authorization Issues: These codes explain transactions that were processed without proper authorization.

- Processing Errors: Chargebacks in this category involve those resulting from technical errors or clerical mistakes.

- Customer Disputes: These codes cover issues like product dissatisfaction, non-receipt, and misdescription.

For businesses using Adyen, understanding these codes is crucial for minimizing chargebacks and guiding dispute resolution. Chargeflow can complement this by automating dispute management and using data analytics to improve response strategies and increase win rates. Integrating Chargeflow allows merchants to efficiently address chargebacks, saving time and enhancing customer trust.

Effective Dispute Management

Step 1: Understanding the Dispute Process

- The dispute process begins when a shopper raises a dispute.

- There are optional stages that may precede a chargeback:

- Optional: Notification of Fraud (NOF): Adyen notifies you of fraud activity, and no money is withdrawn from your account. Take proactive actions such as reviewing the NOF, issuing refunds, blocking the shopper, and stopping shipment if possible.

- Optional: Request for Information (RFI): The issuer requests more information about the transaction. No money is withdrawn at this stage, but if you don't respond timely, a chargeback may occur.

Step 2: Notification of Chargeback (NoC)

- The issuer initiates a chargeback which can be defended.

- Adyen will automatically defend chargebacks that don't require your action, e.g., fraud chargebacks with a liability shift.

- To defend a chargeback that can't be automatically defended, you need to upload defense documents through the Customer Area or Disputes API.

Step 3: Dispute Continuation

- The dispute proceeds through the following stages:

- 1st Chargeback: The disputed amount is withdrawn from your account. This is the final stage if you accept the dispute or fail to upload defense documents.

- Information Supplied: Adyen receives and forwards supporting documents to the scheme. These documents can no longer be changed.

- Chargeback Reversed: The disputed amount is transferred back to your account if the issuer accepts the defense or their response timeframe expires.

- Pre-arbitration (Visa, Mastercard, Diners): If the issuer declines your defense, they open pre-arbitration, which Adyen will review.

- 2nd Chargeback: If the issuer declines your defense or Adyen accepts their pre-arbitration case, a second chargeback occurs. No further defense documents can be uploaded.

Step 4: Defense Timeframes

- Each issuing bank has specific timeframes for handling disputes.

- Cardholders generally have up to 120 calendar days from the transaction date to dispute. For certain cases, like pre-orders or travel-related transactions, this may extend to 540 calendar days.

- Respond to RFIs within specified timeframes: 14 days for consumer reason codes, 7 days for unauthorized purchases, and 96 hours for high-risk orders.

For a full table outlining the defense timeframes click here.

Step 5: Final Decision

- After responding and providing defense documents, expect a final decision.

- If the dispute is lost or you fail to upload documents, your account is debited, and the dispute is considered lost.

Step 6: Optional Status (American Express)

- For American Express chargebacks, a ChargebackReversed status is optional.

- If you defend a dispute successfully, it stays at the information-supplied stage.

- If American Express rejects your defense, you lose the dispute, and this is the final status.

- In exceptional cases, American Express can reopen a dispute that was previously closed in your favor, leading to the second chargeback status, which is the final status.

Understanding and following these steps is crucial for effectively disputing chargebacks with Adyen, ensuring that you can defend your transactions and minimize financial losses in case of disputes.

Leveraging Adyen's Advanced Capabilities for Pre-emptive Chargeback Mitigation and Enhanced Security

Adyen offers a full suite of advanced features to help cater to different payment processing needs for businesses. Their purpose is to enhance the customer experience, streamline operations, and offer robust security measures. Here is an outline of Adyen’s advanced capabilities:

- Real-Time Analytics

The ability to provide businesses with immediate insights into their payment transactions, customer behavior, and performance metrics. Monitor transactions as they happen, identify trends or anomalies, and use these metrics to make informed data-driven decisions. Analyzing in real-time allows businesses to quickly spot unusual activity that could be fraudulent or potential chargeback triggers, like repeated transaction failures or abnormal purchasing behavior, and act accordingly and swiftly.

- Fraud Detection Systems

Built upon sophisticated algorithms and machine learning models to asses each transaction in real-time. With the assistance of device fingerprinting, behavioral analysis, and historical data, risk scores are assigned to transactions. Transactions of high risk can be flagged for manual review or automatically rejected.

- Risk Management Tools

The RevenueProtect suite provides full controls and settings allowing businesses to customize and balance their risk tolerance with customer experience. You can set up rules based on filters and attributes, apply velocity checks, as well as utilize Adyen’s global database for fraud signals. You can fine-tune these settings, preventing your business from unauthorized transactions without inconveniencing your legitimate customers and reducing the incidences of disputes and chargebacks.

- Preemptively Addressing Chargeback Risk

Fusing real-time analytics and advanced fraud detection as well as customizable risk management tools, Adyen provides businesses with a robust framework to effectively identify and mitigate chargeback risks before they even occur. By detecting and halting fraudulent transactions before the action is completed, businesses can significantly reduce the occurrence of chargebacks. Furthermore, real-time insights allow for immediate action, allowing you to connect with your customers to confirm legitimate transactions or adjust the risk parameters in response to emerging threats.

Embracing the Future with Adyen and Upcoming Chargeflow Integration

We've taken a deep dive into some of the most advanced features Adyen rolls out, features empower businesses to succeed, leveraging everything from real-time analytics, through fraud detection and risk management. Adyen has created a payment platform that can handle virtually anything merchants can throw at it, but, of course, this doesn’t mean chargebacks are impossible. Chargebacks can arise from several different issues, from customer disputes to processing errors, and they can’t be avoided if merchants run many transactions. How then can businesses effectively block chargebacks, if the platform is already running at maximum efficiency?

The good news for merchants is that the chance to solve this problem is here. Chargeflow has integrated with Adyen, , check it out here! Chargeflow uses AI-driven technology to provide businesses with real-time dispute management — analyzing dispute data, compiling the best evidence, and submitting winning dispute responses. Merchants integrating Adyen with Chargeflow should be able to run both their payment processing and chargeback management systems through the same platform, reducing chargeback rates far below what any business might see off of payments run through one of those systems separately; which of course, comes out of revenue.

So while Adyen’s real-time analytics, fraud detection, and risk management tools provide a good foundation for finding and blocking off fraudulent transactions that could turn into chargebacks, when coupled with Chargeflow, merchants will have a formidable front to protect against chargebacks, so that there are no fraudulent transactions that need to be found.

Now there is a professional suite of tools out there, which means you don’t have to be the expert or know a ton to have the same kind of defenses against chargebacks as the pros do, and that is a secure environment, working with every major processor.

.png)

%20copy.svg)